Depending on the state you reside in, you could be paying as much as three times higher in federal, state, and local taxes on your cellphone bill than other taxable goods and services. The Tax Foundation released their annual report showing that despite the cost of wireless going down when compared to other goods, government taxes and fees have gone up. In today’s world, wireless devices like cellphones, tablets, and wearables are essential to our daily lives. In fact, by the end of 2022, there were approximately 523 million wireless connections showing how widespread these technologies have become. Maintaining affordable connections is imperative for sustaining the advantages offered by wireless technology, such as promoting mental health, empowering diverse communities, and ultimately bridging the digital divide.

Here are four key findings you should know:

- Cellphone bills are going down, but the price reduction you see has been offset by higher taxes.

Since 2012, the average cost of service from wireless providers decreased by 26 percent. However, over the same timeframe, taxes, fees, and surcharges increased from 17.2 percent to 24.5 percent of the average bill. These taxes, largely the result of federal, state, and local governments’ demand, are burdening everyday Americans relying on wireless connectivity to work, live, and engage with their community. Collectively, Americans will pay about $12.6 billion in taxes, fees, and surcharges in 2023 on wireless service based on current tax rates. - Taxes and fees designated for emergency services might not find their intended use.

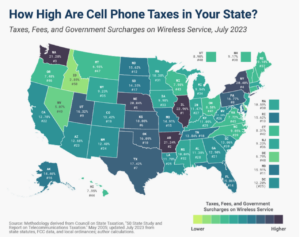

Cellphone fees are set by state and local municipalities and vary from one location to another. In some states and localities those funds are being diverted for general fund purposes. It is important that fees imposed on consumers for 911 purposes are not diverted for other uses. - Consumers in Illinois, Arkansas, and Washington state pay the most, while wireless users in Delaware, Nevada, and Idaho pay the least.

Wireless services are on average subject to state and local taxes 1.76 times higher than the sales taxes imposed on goods, and in 16 states, wireless taxes are actually more than twice as high as sales taxes. These taxes and fees differ state by state, and oftentimes, the discrepancies are significant. - Wireless taxes impose significant burdens on low-income families.

Wireless taxes are regressive, meaning that the taxes place higher burdens on low-income families, in large part due to per-line taxes that charge the same amount on the least expensive and most expensive plans. This fixed structure leads low-income families to spend a greater percentage of their budgets on wireless services – and taxes – than high-income households.According to the Centers for Disease Control and Prevention (CDC), about 78 percent of all low-income adults live in wireless-only households. Considering the increased reliance on wireless among people suffering from poverty, it’s clear these taxes disproportionately affect the very people in the community who need wireless the most.

Join our effort in combatting excessive wireless taxes and fees – like the ones mentioned above – and stay up to date on the latest by joining ACTwireless today.