Costs across the country are rising, including the cost of gasoline, groceries, and electricity. In 2022, 94% of goods and services tracked by the Bureau of Labor Statistics increased over the course of the year. It might surprise you to know that two items that actually went down in price over the last two years include your smartphone and the cost of your wireless service.

Wireless Prices Have Decreased In Face of Historic Inflation

For the last 10 years, the cost of wireless service has steadily declined. This is in large part due to increased competition, meaning that more Americans have a choice in providers and can select a flexible plan that works for them. In fact, the average charge from wireless providers has decreased by 24 percent since 2021, from $47.00 per line per month to $35.74.

However, many are not seeing those savings on the bottom line of the bill. So what’s going on?

Wireless Taxes and Fees Have Jumped for the Fifth Straight Year

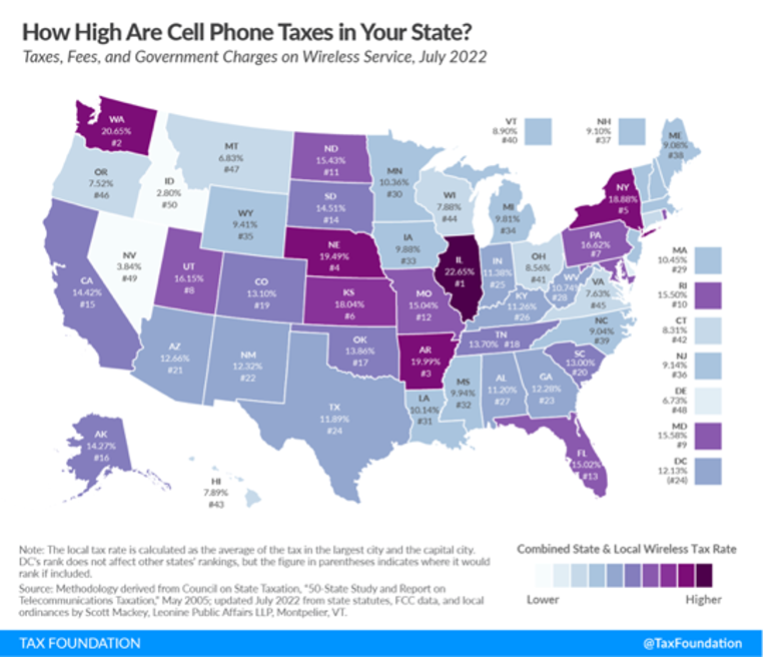

The Tax Foundation’s latest report on the wireless taxes and fees found a disturbing trend: Wireless taxes and fees have jumped for a fifth straight year. A record high nationally, 25.4 percent of the bill on taxable voice services consists of taxes, fees and government surcharges. This means that a typical American household with four phones on a “family share” plan, paying $100 per month for taxable wireless service, would pay nearly $305 per year in taxes, fees, and government surcharges—up slightly from $300 in 2021. In other words, the sneaky reason your cellphone bill is so high is thanks to excessive wireless taxes, fees, and surcharges.

Further, as wireless taxes vary by state, congratulations are in order, or more like condolences, to the residents of Illinois, Washington, Arkansas, Nebraska and New York, who came in at the top of the list for the states with the highest cellphone taxes in the country. Idaho has the lowest wireless tax, which is still high at 15 percent.

Wireless Taxes Unfairly Burden Low-Income Families

More disturbing than the continued increase in taxes is the disparate affect that these taxes continue to have on low-income families. According to the Centers for Disease Control and Prevention (CDC), a higher percentage of low-income adults live in wireless only households compared to the general population of adults. Increasing the cost of access to wireless services disproportionately affects Americans who are least able to afford them.

What Can You Do?

Understanding your wireless bill is an important first step at combating bill shock, as taxes, fees and surcharges can include things like state, municipal, 911, and universal service charges that can be confusing at first glance.

Second, it’s important to know that policymakers are largely responsible for setting the rate of these charges. Wireless broadband access is a high priority for all Americans and with wireless providers constantly offering more affordable plans it is imperative we hold policymakers accountable. Additionally, wireless is an important key to solving the digital divide, so it’s essential that policymakers enact smart policy that address accessibility and affordability gaps, which includes smart wireless tax policy.

Be a part of the effort to rein in wireless taxes by signing up for updates from ACTwireless and stay up-to-date on the latest wireless tax policy issues in your state.