Taxes

In many states, taxes and fees on wireless service are excessive. Governments need to act to reduce discriminatory taxes on wireless consumers.

In many states, taxes and fees on wireless service are excessive and they continue to rise. Over the past decade, wireless taxation increased at a rate seven times faster than the rate on other taxable goods and services. And, because wireless taxes are often regressive, they hit seniors, minority communities, working families and small businesses especially hard.

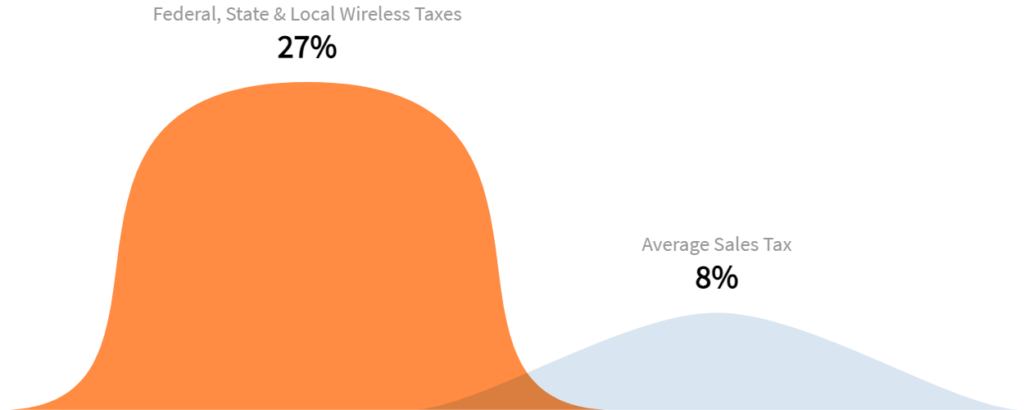

On average, we now pay nearly 27 percent in combined state, local, and federal wireless taxes and fees on our cellphone bill. That’s more than triple the average sales tax rate of nearly 8 percent paid on other goods or services.

Comparing Wireless and Sales Taxes